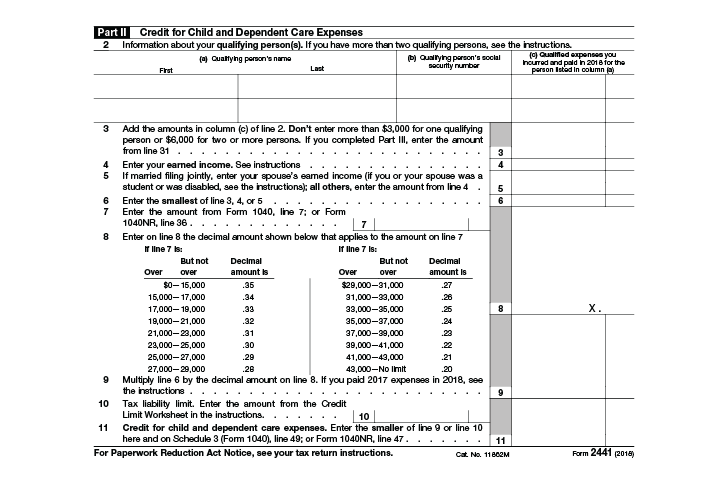

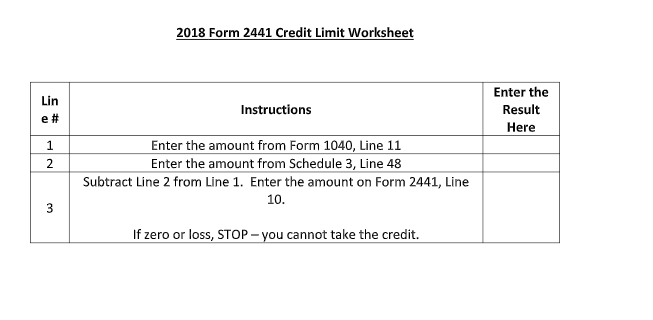

Tax Liability Limit Credit Limit Worksheet. 10 11 Credit for child and dependent care expenses.

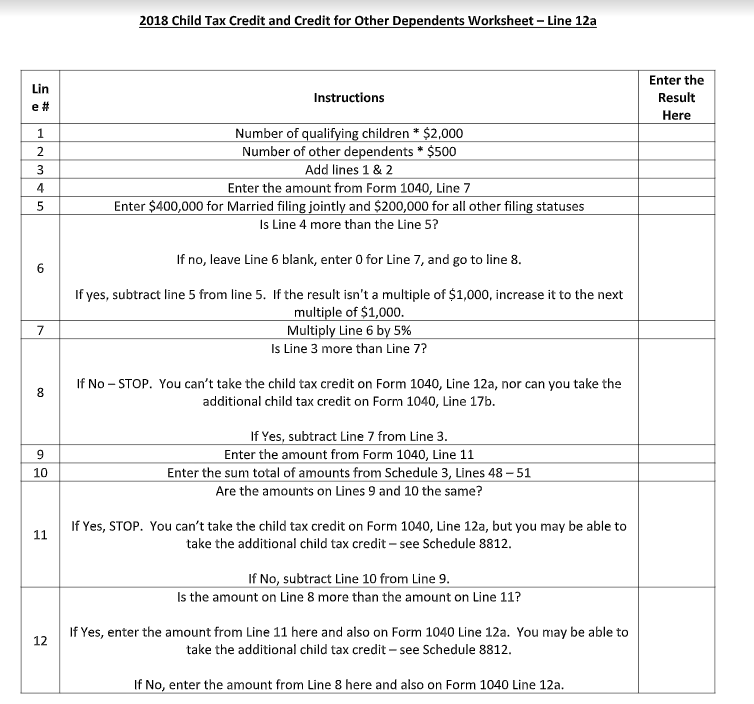

Credit Limit Worksheet Fill Out And Sign Printable Pdf Template Signnow

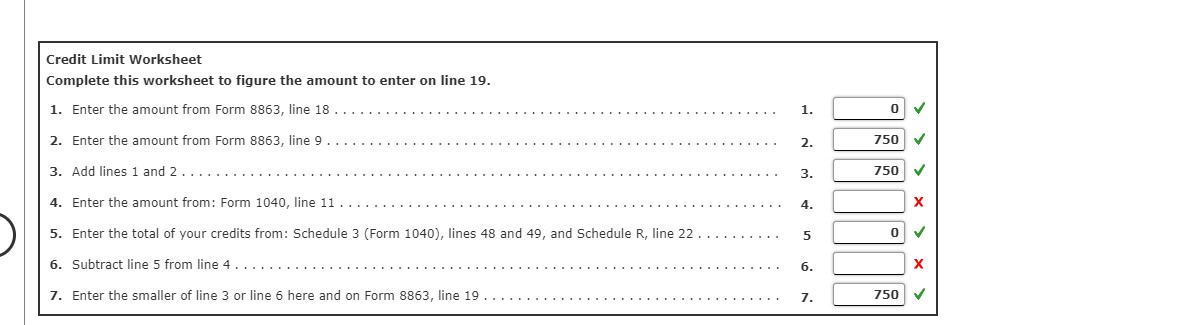

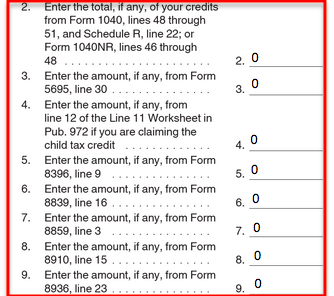

Credit Limit Worksheet Complete this worksheet to figure the amount to enter on line 11.

Tax liability limit credit limit worksheet. In other words if your tax liability is higher than the potential credit you can take the full credit. 10 Tax liability limit. Publication 972 2016 Child Tax Credit from Credit Limit Worksheet sourceirsgov.

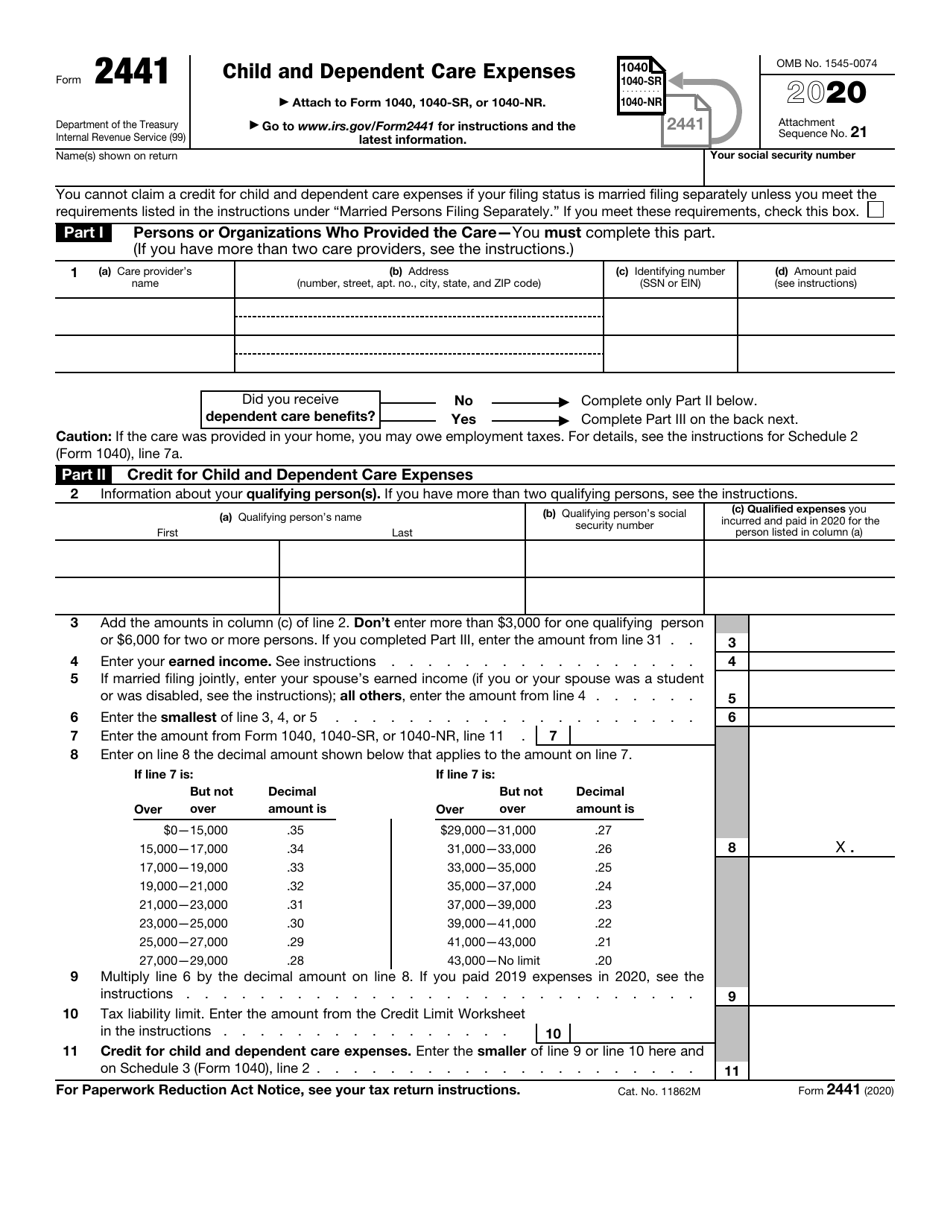

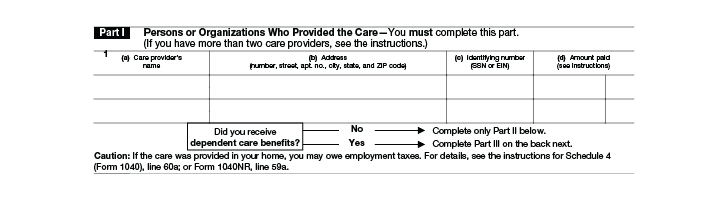

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Form 1040A line 31. In addition if you or your spouse if filing jointly received any dependent care benefits for 2020 you must use Form 2441 to figure the amount if any of the benefits you can exclude from your income.

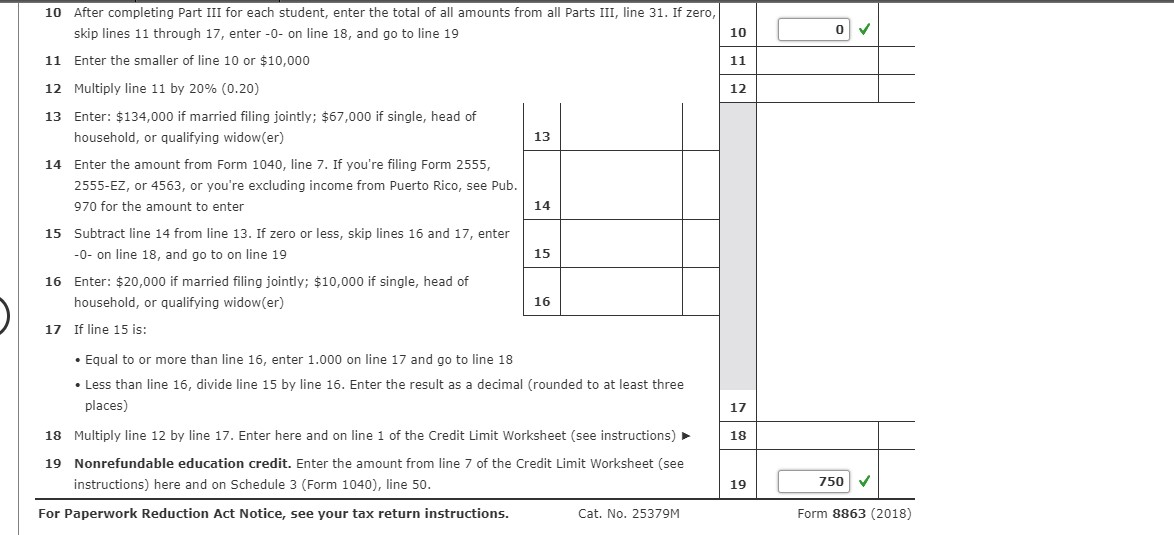

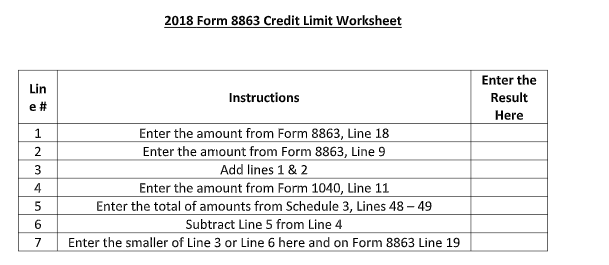

Publication 970 2016 Tax Benefits for Education from Credit Limit Worksheet sourceirsgov. I dont see it in my forms list nor is there a link to it. Enter the amount from the Credit Limit Worksheet in the instructions.

Enter the smaller of line 10 or line 11 here and on Schedule 3 Form 1040 line 4. Form 1040 or 1040-SR filers. Available for PC iOS and Android.

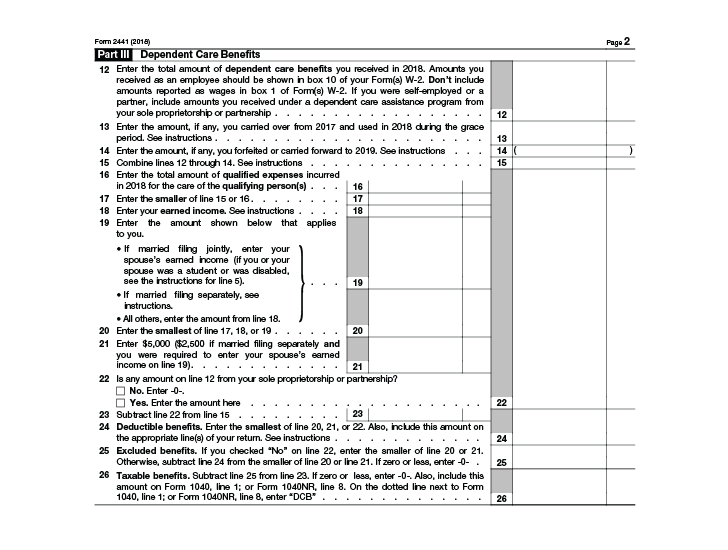

Complete the credit limit worksheet using the information provided in the Dependents section of Form 1040 Pg. Enter the amount from Form 1040 1040-SR or 1040-NR line 18. Then compare this number with the tax liability from the Credit Limit Worksheet in the Form 2441 instructions.

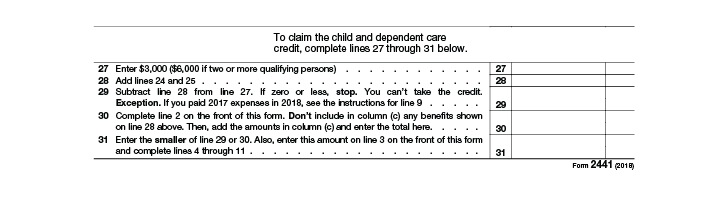

Fill out securely sign print or email your credit limit worksheet form instantly with SignNow. The 6000 limit would still be used to compute your credit unless you have already excluded or deducted in Part III certain dependent care benefits paid to you or on your behalf by your employer. Enter the total of your credits from Schedule 3 lines 1 through 3.

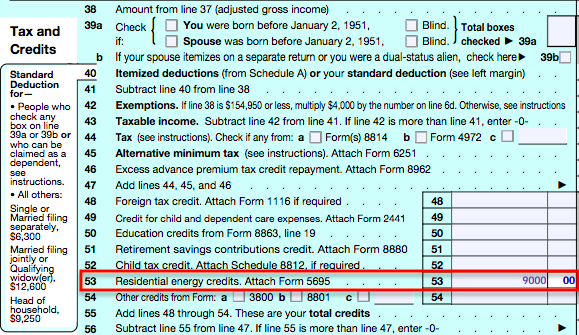

Use the Residential Energy Efficient Property Credit Limit Worksheet on page 4 of the instructions for Form 5695 to determine your limitation based on tax liability if you have any limitations. Enter the amount from the Credit Limit Worksheet in the instructions. Take the credit for child and dependent care expenses.

Enter the smaller of line 20 or line 21. Use the Residential Energy Efficient Properties Energy Credit Limits Worksheet on page 4 as a guide for determining your maximum limit based on the standard tax liability. Start a free trial now to save yourself time and money.

Enter the smaller of line 9 or line 10 here and on Form 1040 line 48. You should also write your Line 11 result the credit itself on line 49 of Schedule 3 Form 1040 or on line 47 of Form 1040NR. 10 Multiply line 7 by line 9.

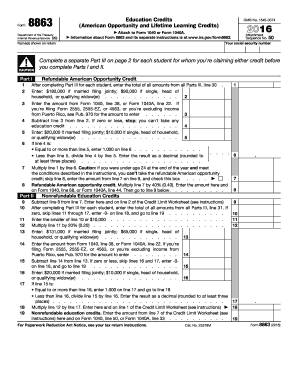

Credit Limit Worksheet 2018. Or Form 1040NR line 47. However my question is about accessing the Credit Limitation Worksheet referred to on the Form 8863 Part II lines 9 and 19.

The smaller figure is your credit amount. If you are subject to the 2000 credit limit because your certificate credit rate is more than 20 no amount over the 2000 limit or your prorated share of the 2000 if you must allocate the credit may be carried forward for use in a later year. The United States federal government helps students offset the costs of postsecondary education through IRS tax credits using Form Tax Form is a two-page IRS document used to claim education credits.

Add the amount on Line 12a to the amount on Schedule 3 Line 55 and input the result on Form 1040 Line 12. 12 See Pub. You must complete Part III of Form 2441 before you can figure the credit if.

Credit for the elderly or the disabled. 11 For Paperwork Reduction Act Notice see your tax return instructions. Turbotax shows Line 17 2.

The education credits are designed to offset higher education expenses paid to an eligible postsecondary. Credit limit credit report credit score creditworthiness default delinquent equal credit opportunity act ecoa fair credit reporting act fcra inquiry installment credit closed revolving credit open secured credit service credit utilization the abcs of credit reporting. Or Form 1040NR line 46.

590-A for the amount to enter if you claim any exclusion or deduction for foreign. The smaller figure is your credit amount. Enter the smaller of line 9 or line 10 here and on Form 1040 line 49.

See Schedule R Form 1040 to figure the credit. On Line 11 enter the smaller of Line 9 or Line 10. Enter the amount from the Credit Limit Worksheet in the instructions 11 12 Credit for qualified retirement savings contributions.

11 For Paperwork Reduction Act Notice see your tax return instructions. Credit limit worksheet. Pa municipality tax return out of state credit for school.

My clients credit was limited and I want to look over the worksheet to see why. 1 and input the result on Form 1040 Line 12a. On the other hand if youve typically had 500 and 1000 credit limits its unlikely that youll be approved for a 10000 credit limit.

On line 1 of the Residential Energy Efficient Property Credit Limit Worksheet section enter your total federal tax liability. Form 1040A line 29. On Line 10 enter your tax liability limit from the attached worksheet.

On Line 11 enter the smaller of Line 9 or Line 10. 10 11 Credit for child and dependent care expenses. Enter the amount from the Credit Limit Worksheet in the instructions field is blank 22.

9 10 Tax liability limit. You should list -0- for the one child and the actual amount for the second child. Enter the amount from the Credit Limit Worksheet in the instructions.

10 11 Limitation based on tax liability. Thank you for your reply. Also enter this amount on Schedule 3 Form 1040 or Form 1040-SR line 6 check box c and enter Sch R on the line next to that box field is blank.

Form 2441 Child And Dependent Care Expenses 2014 Free Download

Case Information John And Mary Remington Are Married Chegg Com

I Just Need Help On The 2 Blanks At The Bottom Chegg Com

Case Information John And Mary Remington Are Married Chegg Com

I Just Need Help On The 2 Blanks At The Bottom Chegg Com

Claiming The Federal Tax Credit Mosaic

Claiming The Federal Tax Credit Mosaic

Case Information John And Mary Remington Are Married Chegg Com

How To Fill Out Irs Form 2441 Smartasset

Please Use Information To Fill Out 2441 Front Page Of Chegg Com

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

Irs Form 2441 Download Fillable Pdf Or Fill Online Child And Dependent Care Expenses 2020 Templateroller

How To Fill Out Irs Form 2441 Smartasset

How To Fill Out Irs Form 2441 Smartasset

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

0 comments