Consequently using the Spouse Tax Adjustment can result in a tax savings of up to 259. Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work.

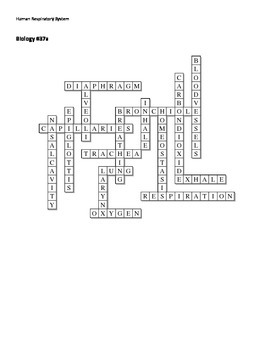

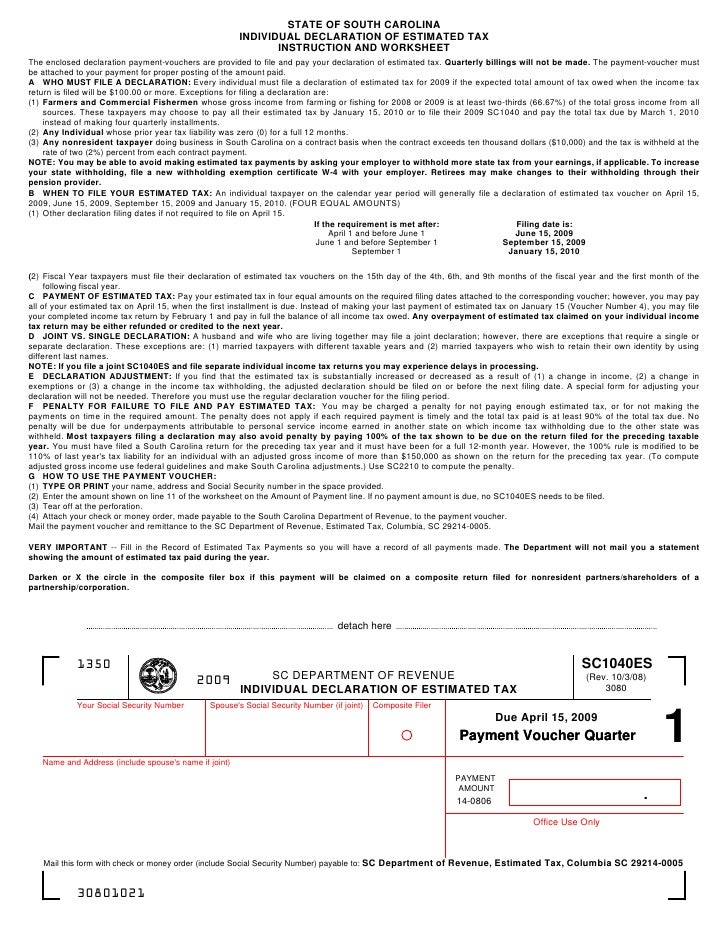

Individual Declaration Of Estimated Tax With Instructions And Workshe

Virginia Spouse Tax Adjustment Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and accounting 2019 form w 4.

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

Spouse tax adjustment worksheet. As a result the first 17000 of each of their incomes will be taxed at the lower rates. Virginia Spouse Tax Adjustment Worksheets. Some of the worksheets displayed are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and.

The STA allows married couples to file joint returns without paying higher taxes than if they had filed separately. Complete a pro forma federal Form 1040. Please complete this form submit it to the Financial Aid Office with ALL.

Virginia Spouse Tax Adjustment Displaying top 8 worksheets found for - Virginia Spouse Tax Adjustment. 2010 Old Law For deaths in 2010 only No estate tax. Incomeexpense adjustment you must submit this worksheet and the required documentation to the Student Financial Aid Office.

Salary Adjustment Form Template. Underpayment of Estimated Insurance Premiums License Tax Schedule 800CR. If a couple elects to use the Spouse Tax Adjustment they calculate their income tax separately using the Spouse Tax Adjustment worksheet.

Both spouses benefit from the sta both incomes reported on jointly filed separately. Irrevocable trust of decedent. Enter amounts for yourself and spouse in their respective columns.

Tax Worksheet For Rental Property. 2017-2018 Independent Student Income Adjustment Worksheet NAME. Collection date_____ In-person initial.

Select the lower tax adjustment worksheet received income during the taxable year. A pro forma federal Form 1040 must be prepared using the same filing status used on your California tax return. Adjustment Has to be owned by the decedent at the time of death.

Excel Worksheet Name Property. 2 due to a period of unemployment a change. Form 1065 is closed by APS using Form 5403 but a Form 5403 Worksheet is not required.

Vermont Tax Worksheet In 152. Showing top 8 worksheets in the category - Adjustment Disorder. Capital Gains Worksheet Adjustment Codes.

As a result the first 17000 of each of their incomes will be taxed at the lower rates. Consequently using the Spouse Tax Adjustment can result in. Virginia Spouse Tax Adjustment - Displaying top 8 worksheets found for this concept.

Tell the representativespouse to do a balance. Spouse Tax Adjustment Worksheet. Complete the California RDP Adjustments Worksheet included in this publication.

Insurance Premiums License Tax Worksheet Schedule 800B. Vermont American Router Letter Template Set. Some of the worksheets displayed are Djustment disorders Adjustment disorder with depression or anxiety Adnm 20 questionnaire adjustment disorder new module 20 Ibhc resources and handouts Adjustment disorder Cognitive beahvioral therapy for adjustment disorder Adjustment disorders description Anxiety toolbox.

If an independent students andor their spouses 2016 income or 2017 or 2018 income has changed from the 2015 tax year. Paying higher taxes than if each spouse tax adjustment worksheet sta is used. A pro forma federal Form 1040 is a federal tax return completed in the same manner that a married couple.

Vba Worksheet Name Property. 2019 2020 W-2s andor 1099s with all required IRS tax schedules. Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and.

If a request is made after 12182021 a 2021 IRS Tax Transcript or 2021 Federal Income Tax Returns with signatures will. Virginia income during the lower tax rates if each spouse in their respective columns. Generally a Form 5403 Worksheet is not required for innocent spouse cases.

Property Tax Worksheet Mn. Use the calculator below to compute the Spouse Tax Adjustment STA amount to enter on your Virginia income tax return. Taxvirginiagov If a couple elects to use the Spouse Tax Adjustment they calculate their income tax separately using the Spouse Tax Adjustment worksheet.

Some of the worksheets for this concept are Instructions for preparing nonresident Resident individual income tax booklet Instructions for 2015 pit adj schedule of additions Tax return fee schedule 2014 kentucky individual income tax instructions for forms Optional basis adjustments Test scenario 3 Oklahoma form 511nr rental investor 511 carol blvd. APS uses information from other sources Form 5402 a tax computation form an allocation worksheet etc to make any necessary account adjustments. Displaying top 8 worksheets found for - Spouse Tax Adj.

Modified Carryover Basis Basis is lesser of decedent adjusted basis or. Basis modified carryover basis - of adjusted basis or FMV 12. Typed signed and dated detailed statement explaining your circumstances for requesting an income adjustment.

Insurance Premiums License Tax Credit Schedule Schedule 800RET. Loss of income Student spouse or step parent of dependent student has had a significant loss of income that is not reflected on the 202. Guaranty Fund Assessment Credit Worksheet 800C.

Spouse or parents have experienced a significant decrease in income since 2018 due to one of the conditions described on this form you may be eligible for an income adjustment to the FAFSA. Virginia Spouse Tax Adjustment Showing top 8 worksheets in the category - Virginia Spouse Tax Adjustment.